About Us

Codeinsects IT Pvt Ltd is a software development company established in 2013. It’s a place where technology meet uniqueness, company provide integrated technological solutions to small and medium and large enterprises or SMEs.

Codeinsects IT Pvt Ltd has sharp focus on innovative web designing and core development. We are known for providing high quality web solutions to the clients. We are the one who cares about small and medium business requirements.

Inspired to produce creative solutions that propel brands. At Codeinsects, we have problem solvers, creative strategists and brand builders.

Providing wonderful results while working with hand-picked programmers, designers, writers and other professionals in the industry.

Know More

Our Services

Over 15 Years Expericences we are working with business & provide solution to client with their business problem

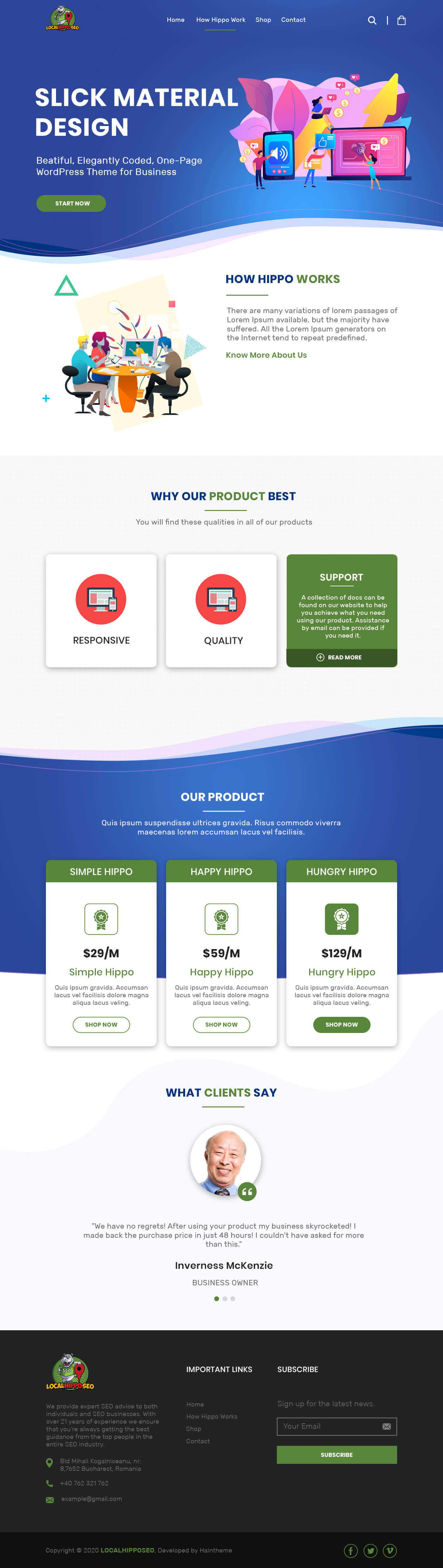

Web Design

We strive to give our clients the best and creative designs we can come up with that matches to their needs.

Web Development

Are you yearning to be one of the most reputable online brand attracting the most prospective audience? If yes, Codeinsects IT Pvt Ltd can prove to be your ideal partner for shaping your vision.

SEO Consulting

Not sure what you need, but have an SEO budget? We’ll help you define a custom needs assessment and strategy for long-term search marketing success. We make Trees, you enjoy Fruits.

Ecommerce

The innovative and pioneering E-commerce services by Codeinsects IT Pvt Ltd enable your business to find its feet in the present online scenario boosting your revenue flow.

Mobile App Development

tempor incididunt ut labore et dolore magna aliqua. Ut enim adita minim lagbore emit.

Support

Strong support team to support your network proactively. We are happy to help in your business.

Best Features

Our working process is a carefully devised plan where success depends on true collaboration between you and us. We at Codeinsects believe that a truly stunning solution can only be delivered when all stakeholders come together to work as one team.

Awesome Layout

Pain and trouble that are bounto ensue; and equal blame belongs to those who fail in their duty through weakness of.

CREATIVE TEAM

Pain and trouble that are bounto ensue; and equal blame belongs to those who fail in their duty through weakness of.

Quick Support

Pain and trouble that are bounto ensue; and equal blame belongs to those who fail in their duty through weakness of.

Free Updates

Pain and trouble that are bounto ensue; and equal blame belongs to those who fail in their duty through weakness of.

Brand Expert

Pain and trouble that are bounto ensue; and equal blame belongs to those who fail in their duty through weakness of.

Organised Team

Pain and trouble that are bounto ensue; and equal blame belongs to those who fail in their duty through weakness of.

Lets See Some

Funfacts About Us

Over 15 Years Expericences we are working with business & provide solution to client with their business problem

- Happy Clients 00

- Project Complete 00

- Cups of tea 00

- ti-crown 00

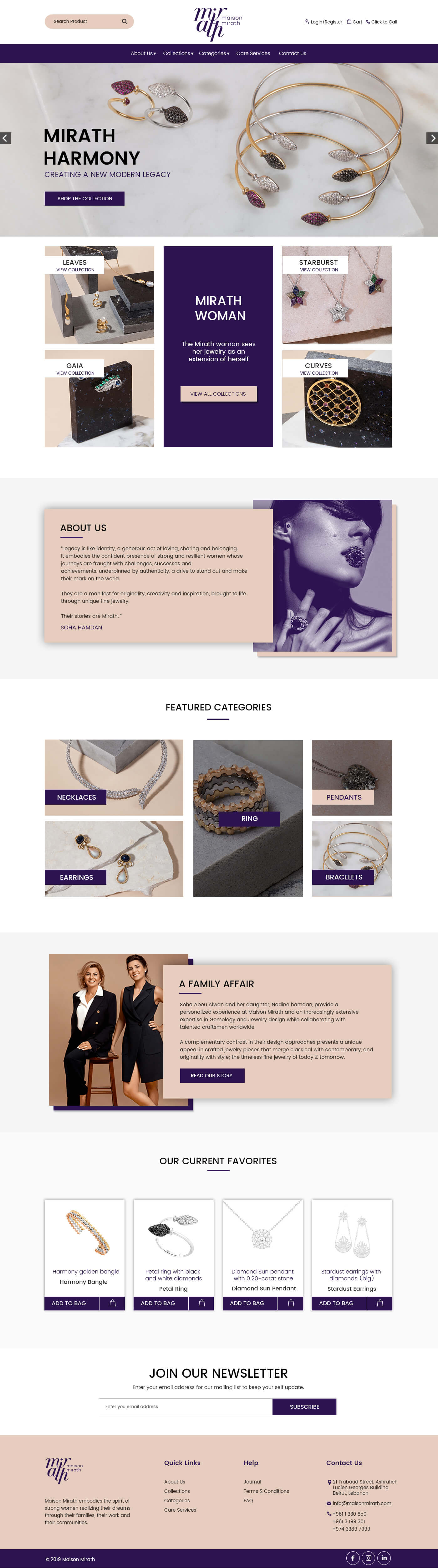

Featured Work

Over 10 Years Expericences we are working with business & provide solution to client with their business problem

Our Expertise Areas

Over 10 Years Expericences we are working with business & provide solution to client with their business problem

Testimonials

Over 10 Years Expericences we are working with business & provide solution to client with their business problem